Subprime mortgages in Arizona have been thought-about a

predatory lending observe by many laws makers. The small print current in another case as

Arizona home loans with very bad credit report purposes

have often been utilized by merchants

as a money making method, not by people who’ve been taken advantage of by

banks.)

A

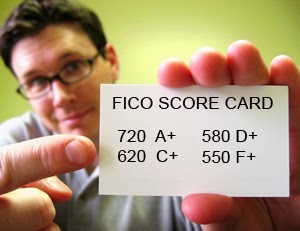

subprime mortgage is a lending observe that will revenue debtors with low

credit score rating scores. Normally, subprime mortgages are given to debtors with a a lot much less

than stellar credit score rating historic previous or to debtors with completely different financial elements that

make them an extreme quantity of a obligation for a standard loan. Primarily based totally on these elements,

the debtors would not qualify for a standard mortgage so banks give them a

subprime loan with the subsequent than widespread charge of curiosity. Because of subprime

debtors signify the subsequent risk for the lender, most lenders price the subsequent

than prime charge of curiosity.

The

commonest sort of subprime mortgages which could be provided are adjustable charge

mortgages or ARMs. An adjustable charge mortgage initially affords a very low

charge of curiosity, usually underneath the prime charge provided by a standard loan. For

an educated investor who intends to restore and flip or solely private a home for a short

timeframe, an adjustable charge mortgage may very well be a pleasant funding instrument.

Nonetheless, an ARM is significantly misleading to uninformed debtors as a result of it initially

bills a lower charge of curiosity. After the ARM interval the velocity adjusts to a

significantly elevated charge and higher month-to-month price. These sort of mortgages

acquired out repeatedly by banks to un-creditworthy patrons in 2005 and 2006.

As quickly because the loan reset to the higher charge of curiosity, many debtors have been unable to

afford their new month-to-month funds and defaulted on their dwelling loans. ARM have been

largely answerable for the rise of subprime mortgage foreclosures will enhance

inside the mid-2000s.

In

addition to ARMs, many private equity firms and hedge funds moreover give subprime

loans. Charges of curiosity are sometimes elevated for these loans on account of the debtors

signify the subsequent credit score rating risk to the lender. Although there have been some

predatory lenders, almost all of those firms want to help create a win-win

state of affairs. Consumers make money and debtors are able to purchase homes.

In response to the foreclosures catastrophe, may laws makers want to take away

Arizona home loans with bad credit purposes

utterly. They cite a majority of those loans as being predatory lending practices

as a result of the charges of curiosity can attain as extreme as 9% when a standard loan hovers

spherical 4%. Moreover they declare that these loans are disproportionately given to

people who make decrease than the median diploma of income and there could also be moreover fear

that subprime mortgages may injury minorities or youthful of us.

As mentioned above, there could also be concern amongst laws makers that

Arizona dwelling loans with very bad credit report are

designed by banks to understand basically essentially the most money from groups who’ve the least. The

foreclosures of the mid-2000s helped fuel this fireplace. Politicians and loan

reform groups make various claims regarding the unsavory nature of subprime

lending in Arizona, nonetheless, lots of these claims have been confirmed inaccurate

when the numbers are examined.

The

first declare by politicians searching for to discredit subprime lending in Arizona is

that it’ll unfairly discriminate in opposition to low income debtors. This declare is

categorically false. Truly, most subprime debtors in Arizona are above the

median income line. Most subprime mortgages are often second mortgages that

are purchased as funding properties. Subprime debtors moreover are more likely to private

fewer low price homes than standard mortgage holders.

A

second declare in opposition to sub prime mortgages Arizona is that subprime loans are unfairly given out to debtors who’re

youthful and never utilizing a considerable credit score rating historic previous. Subprime mortgages aren’t given

out to largely youthful debtors. Truly, the widespread age of a borrower for a

subprime mortgage was between 35 and 55 years of age. Because of this

subprime mortgages do not get used to penalize debtors with insufficient

credit score rating historic previous due to age.

Lastly,

one different criticism is that minority borrower will in all probability be discriminated in opposition to and

solely provided extreme curiosity loans. A demographic analysis signifies that that’s

untrue. By analyzing zip codes and demographics, it was concluded that subprime

mortgages aren’t additional widespread in zip codes with a Hispanic inhabitants

focus.

Subprime mortgages

aren’t being utilized by banks to unfairly discriminate in opposition to debtors, comparatively

than are a valuable instrument for debtors with low credit score rating scores or as a way to

purchase an funding property.

Since subprime mortgages usually price elevated charges of curiosity,

they’ve sadly been lumped into the an identical class as title or payday

loans. Some politicians see them as predatory practices with out having all the

particulars.

Arizona home loans with bad credit purposes and loans aren’t a predatory lending observe by banks.

Comparatively they are a instrument that may be utilized for debtors that will in another case not

qualify for a mortgage. Whether or not or not you are shopping for a second dwelling as funding,

or purchasing for a home in your family members to dwell in, don’t let a low credit score rating ranking

determine your future. Contact a neighborhood mortgage vendor to search out out your decisions

and see if a subprime loan is an environment friendly chance for you.

Stage 4 Funding LLC

Arizona Tel: (623) 582-4444

Arizona Tel: (512) 516-1177

www.setabay.com

NMLS 1057378 | AZMB 0923961 | MLO 1057378

22601 N 19th Ave Suite 112

Phoenix AZ 85027