credit score rating ask is: How do I buy a house with bad credit? Now likelihood is you may be questioning

what a sub prime mortgage is and the best way it would revenue you.

Pretty merely a sub

prime mortgage is a loan supplied to an individual that is considered a

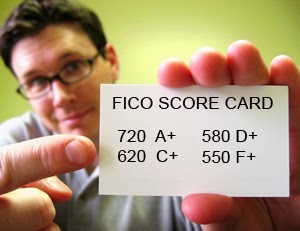

high-risk borrower, due to their credit score standing. Subprime debtors who’ve a

credit score rating score of decrease than 640 won’t be the norm, nonetheless this will likely more and more differ relying

on the lender. Since it is the lender who’s assuming this menace, the curiosity

worth for a home loan may additionally be bigger. Some sub prime naysayers complain that

the curiosity on these loans is unfair. Nonetheless for sure in Arizona how

to buy a house with horrible credit score, there are a variety of types of subprime financing

accessible. In actuality, using this form of financing precisely may grow to be

useful.

inside the state is called an adjustable worth mortgage or ARM. An ARM begins by

having a low-cost fee of curiosity that is locked-in for a specified interval of

time, typically between 1 and 7 years. On the end of the time interval, the velocity adjusts

to a greater worth. Adjustable worth mortgages have earned a nasty standing inside the

mid-2000s for the perform inside the foreclosures bubble. That being talked about, it is

important so as to understand that the majority of those ARMs have been outfitted to customers

with a horrible credit score report who merely overextended themselves. They merely bought

additional dwelling than they could afford. When the velocity reset, they could no longer make

their month-to-month obligations.

Although the velocity of ARMs does regulate with time, bear in mind

refinancing to a lower mounted worth mortgage or one different adjustable worth mortgage.

Taking advantages of the decreased curiosity prices of an ARM may forestall

a whole lot on mortgage curiosity. The money you save in curiosity will be utilized to

repay the stability of your loan and consequently allow you to pay

significantly a lot much less curiosity.

Utilizing an ARM Arizona: how to buy a house with bad credit

additional money than the exact price of the acquisition. It merely doesn’t make sense.

Let’s be honest, most people do not dwell in a home for 30 years. In actuality the

frequent time frame to dwell in a house eight to 10 years. Even when the homeowners

resolve to stay longer, the overwhelming majority of people end up refinancing their mortgage

not lower than as quickly as. Some homeowners refinance as normally as every 2-Three years.

purchaser significantly additional money upfront. It’s as a result of these ARMs require the

purchaser to pay the overwhelming majority of the loan all through the primary half of the time interval. The

standard 30-year loan nevertheless, prices a greater mortgage worth as a

kind of insurance coverage protection for the lender. Your loan provider assumes you may take 30

years to settle the debt. Thirty years is a really very long time and there is a probability

that one factor may happen that will set off you to default. The loan provider

prices you a greater fee of curiosity to make additional money in case of default. The

adjustable costs are solely about 1 to 7 years to permit them to offer a lower curiosity

worth as a result of the time interval is shorter and fewer harmful for the lender. These ARMs have

lower charges of curiosity than your standard mortgage, and should forestall vital

portions of money. On reflection, a typical mortgage can worth you a whole lot

of in premiums over all of the lifetime of the loan. Subprime mortgages

should be thought-about by every prime and sub prime debtors alike, merely for

it’s distinctive benefits. Beneath are just some situations when an adjustable worth

mortgage might really make additional sense than a typical mortgage.

- When you will have poor credit score rating it’s worthwhile to restore. ARMs are

unbelievable devices to help rebuild your credit score rating. Refinancing sooner than the costs

regulate all through the course of the loan proves to be a superb method to boost

credit score rating and get you in a home faster. - In case you plan to unload your property sooner than the costs

reset and rise. This works everytime you intend on residing inside the dwelling for a short

whereas. Selling sooner than the costs rise can help you stay away from having to pay expensive

premiums. - For those who’re planning

to boost the home to later advertise for a income. In situations the place you is likely to be

not planning for a long-term funding, an ARM can forestall money while you

are remodeling a home. - If you find yourself depend on to earn additional money inside the near future.

On this case, if the loan resets, the higher charges of curiosity acquired’t matter on account of

they’re going to be easier to repay. - For those who’re anticipating

to acquire an inheritance or lump sum of money. After receiving a windfall, it’s

typically easier to repay any remaining balances of a mortgage. On this

situation the ARM serves as an instrument that will protect your month-to-month funds

low as you repay the mortgage.

mortgages, these pitfalls are typically minimized by intelligent investing and

evaluation.

of loans is to certainly not overextend and to be honest alongside along with your funds. An ARM normally

permits customers to buy a home that’s bigger than one they could afford. Bear in

ideas that when these costs reset they’ll on a regular basis be raised and should worth you

out of your property, which may end up in foreclosures.

in all probability probably the most up-to-date Arizona sub prime mortgage programs. Discover ways to

buy a house with horrible credit score in Arizona and what makes in all probability probably the most financial sense for you and

your loved ones.