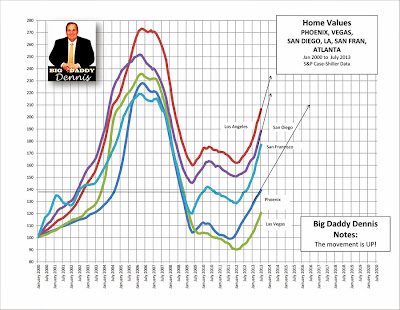

Phoenix Precise Property values proceed to go up! Dwelling Values 40%

Dwelling values throughout the Phoenix Arizona Metropolitan house proceed to rise! We’re all excited to see an increase in home values of close to 22% from the prior 12 months (July 2012 – July 2013). It’s good to lastly see home values march forward to the place we want them to be.

The low level in values was formally August 2011, and since then values have elevated 40% as a result of the low level. I do know what we’re all contemplating… Oh, if I solely would have purchased a bunch of properties August 2011! Nonetheless the truth of the matter is, not many people may make that purchase in 2011.

Month-to-month price improve of home values throughout the Phoenix Arizona Metropolitan market since July 2012 was a median of 1.6% per thirty days. For those who occur to do the maths, that suggests home with a price of $200,000 elevated in price by $three,200 per thirty days or $107 per day! Pretty unbelievable to contemplate.

Dwelling improve prices are matching the frenzy that we’ve got expert – and in addition you might remember- in July 2004.

Statistically, due to this the slope of the street values of values for July 1013 is similar as a result of it was in 2004.

For the western part of the US, city of San Francisco throughout the sunshine state of Arizona is experiencing the most effective rise in home prices with a 29% obtain from July 2012 to July 2013 and an increase of 35% from the Low August 2011 prices, as you probably can see on the chart.

What’s top-of-the-line part of the home price progress? We’re so happy to say that since August 2011, the rise in home prices have been fastened with out any pull once more, which suggests the enlargement of the market is highly effective and might proceed getting stronger.

Stage 4 Funding LLC

22601 N 19th Ave Suite 112

Phoenix AZ 85027

623-582-4444

AZMB 0923961 NMLS 1018071

Let’s protect the rising going!