extreme demand as charges of curiosity are dropping and housing inventory is rising.

A mortgage seller will assist you choose the easiest loan in your financial

state of affairs and make your homeownership targets come true.

temperatures, and a great deal of strategies to beat the summer season season heat, it is easy to see

why. Arizona has relatively so much to produce to individuals and households. Whether or not or not you is likely to be

shifting to the Mortgage Star State for work, the local weather, or for the entire family

nice actions and areas, there’s one thing in Arizona for

all people.

Arizona is unattainable. Chances are high you will assume that Arizona home loans for below-average credit score don’t exist. This has been a widespread and false

rumor given that housing catastrophe of 2008. Many people contemplate that it is

unattainable to get a home loan with out glorious credit score rating. In a fashion, this has grow to be

a self-fulfilling prophesy because of many individuals and households with unhealthy

credit score rating obtained’t even apply for a loan for concern they will merely be turned down by

the monetary establishment. Nonetheless, there are quite a lot of functions in Arizona that will help sub-prime

debtors meet eligibility requirements for dwelling loans.

Types of Arizona Dwelling Loans

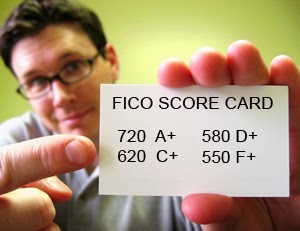

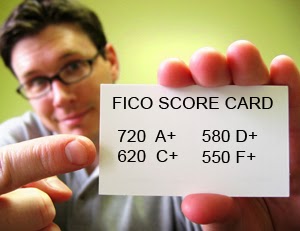

routinely assume they can not qualify for this sort of loan. Whereas a

standard mortgage does have most likely essentially the most stringent credit score rating requirements, they’re

not as extreme as many people contemplate. Whenever you’ve received a ranking of not lower than 650 you

have a chance to qualify for the standard loan. A standard loan is a set

15 to 30 yr loan with funds that will keep roughly the equivalent for the

full loan time interval. Funds would possibly fluctuate barely based on property tax portions

nonetheless they principal and curiosity will keep the equivalent. In an effort to qualify for a

standard loan you must to put between 5 and 20 p.c of the loan

amount down.

for. One among many principal styles of loans that will help sub-prime debtors is an FHA

loan. An FHA loan is a loan that is secured by the federal authorities. You will

pay a set worth for principal and curiosity for a 15 to 30 yr loan time interval. You

will even pay mortgage insurance coverage protection inside the amount of 80 to 200 each month,

counting on the amount of your loan. You presumably can qualify for an FHA loan with a

credit score rating ranking as little as 500 as long as you would have between three.5 and 10 p.c of the

loan price to put down.

loan, there are some a lot much less widespread functions which may be capable to make it simpler to buy a

dwelling in Arizona. One is a lease to non-public program. Whilst you lease to non-public, you pay

lease that for the first 18-24 months goes within the route of creating a down price on the

dwelling. Your lease funds is likely to be higher than should you occur to have been merely renting the home

nonetheless you may be making progress within the route of proudly proudly owning it. One different methodology to purchase a

dwelling with below-average credit score is with vendor financing. That’s commonest if the

vendor owns the home outright or owes a very small amount left on the mortgage.

The seller carries the debt for you and in addition you make month-to-month funds, along with

curiosity to the seller. Usually you must to put a giant chunk down so that

they vendor is assured that you have a vested curiosity in paying the loan in

full by the agreed upon time interval. Lastly, you might also have to have a

member of the household with higher credit score rating cosign for you. This could make it simpler to get a loan

and be on monitor to rebuilding your credit score rating. Nonetheless, keep in mind that any late

funds will even impact the credit score rating of your cosigner.

Regardless of which loan product you

choose, a Arizona mortgage seller will assist you reap the benefits of Arizona dwelling loans.

A licensed seller can negotiate with quite a few lenders to help get them to see

you as higher than a credit score rating ranking. In actuality, many people who’ve gotten dwelling

loans with below-average credit score declare that they owe their success to a seller who was

working for them. Identify a seller proper now to begin out the strategy of proudly proudly owning your particular person

dwelling. You could be glad you most likely did.

In case you might be having a tricky time with typical monetary establishment loans, please know that there is one different approach to getting the money that you just need. Don’t get disheartened pretty however. Banks are slicing once more fairly a bit on how lots money they provide out, nevertheless there are completely different selections and it’s time you get your

In case you might be having a tricky time with typical monetary establishment loans, please know that there is one different approach to getting the money that you just need. Don’t get disheartened pretty however. Banks are slicing once more fairly a bit on how lots money they provide out, nevertheless there are completely different selections and it’s time you get your