good gives, it is no marvel that so many people want to switch to Arizona. With

some components of the state getting over 300 days of sunshine yearly and snowboarding

throughout the northern part of the state, it is the superb place of us with any

native climate alternative. The comparatively low humidity moreover makes it excellent for people

with respiratory points and delicate winters are good for snow birds. In case you

find yourself dreaming of shifting to Arizona, nonetheless have a bad credit report rating, you should have

to start researching Arizona sub prime mortgage to review in regards to the a number of forms of mortgages on the market throughout the

state for debtors with a bad credit report rating or extreme debt to earnings ratios. In case you

cannot qualify for the standard mortgage due to a low credit score rating ranking, a subprime

mortgage could also be an excellent risk.

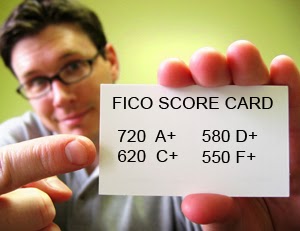

be a greater risk due to a poor credit score rating ranking. Often a sub prime borrower has

a credit score rating ranking of decrease than 640, nonetheless this does differ. Given that lender is

assuming a greater risk, the speed of curiosity will also be often larger. Critics of

subprime lending argue that it bills unfair charges of curiosity and extra

burdens individuals with low incomes and extreme portions of debt. However, for

many individuals, a subprime mortgage, Arizona is the one method they are going to qualify for a home loan. There are a variety of

sorts of subprime mortgages on the market and all types has completely completely different advantages

and risks.

for practically 42.5 million Folks, it is the solely dwelling loan they are going to qualify

for due to a low credit score rating ranking. If you find yourself having problem buying a

dwelling loan in Arizona based in your credit score rating, do your evaluation on subprime mortgage Arizona to search out out

the type of loan packages you may probably qualify for. Understanding the completely completely different

sorts of subprime mortgages can help you select the appropriate product for you and

your family members.

Forms of Mortgages Obtainable to Debtors

with Unhealthy Credit score rating

on the market to subprime debtors is what known as an adjustable cost mortgage

or ARM. An ARM begins off at a low price of curiosity, usually lower than the prime

cost spherical 2-Three %. After a timeframe from 1 to 5 years, the velocity then

adjusts to a quite a bit larger cost anyplace from 10 to 20 %, counting on

market circumstances. This will set off your value to go up shortly. ARMs acquired a

unhealthy recognition via the housing catastrophe of the mid 2000s and had been accused of

being a way for banks to loan money to and reap the advantages of subprime

debtors. Many people misplaced their dwelling because of lack of capacity to make the model new,

larger funds after the velocity adjusted. An ARM is often risk in the event you’re

throughout the technique of rebuilding your credit score rating and might be succesful to refinance to a

standard loan sooner than your cost adjusts. It is also an excellent risk in the event you’re

searching for a short time interval dwelling to each restore and flip, in any other case you intend on shifting inside

the low cost interval. An ARM will also be an excellent risk as long as you funds accordingly

so you aren’t getting priced out of your property and wind up unable to pay your

mortgage.

type of subprime loan is a hard money loan. A hard money loan is obtainable by a

group of merchants, barely than a monetary establishment. It is a temporary time interval loan that is

designed primarily for restore and flip houses. Since merchants are offering the

loan, not a monetary establishment, they’re further seemingly to offer loans to debtors with low

credit score rating, providing they’ve a sound precise property funding. Onerous money loans

are sometimes temporary time interval loans and closing for a pair years. A hard money loan is

an excellent funding nonetheless not in the event you’re planning on dwelling throughout the dwelling for any

time period.

is in the marketplace to low credit score rating debtors is an FHA loan. This kind of loan is backed

by the federal authorities and affords low charges of curiosity and low down value

decisions. Most FHA loans solely require a Three.5% down value which makes it a super

risk for debtors with out a substantial quantity of liquid money belongings. That’s moreover

a super risk for any individual searching for a second dwelling who may not have the down

value they’d have within the occasion that they purchased their first dwelling. The loan is insured by

the federal authorities so the borrower will end up paying what is named main

mortgage insurance coverage protection or PMI funds. PMI funds can range from anyplace

between 80 and a few hundred so it does improve your month-to-month mortgage

value. You may make these funds until you might have paid off 20% of your property

loan.

Deciding on the right loan product is essential to making your sub prime borrowing experience positive.

may also qualify for positive federal packages that present down value

assist or money once more at closing. Just a few of those embody the Dwelling in 5 program

or the Dwelling Fairly priced Refinance Program (HARP). Title a Arizona mortgage

vendor to help get you started in your switch to the Mortgage Star State.